When navigating the legal landscape of business ownership, understanding the distinction between a trademark and an LLC (Limited Liability Company) is crucial for protecting your venture. A trademark primarily safeguards branding elements such as logos, slogans, and service marks that distinguish your products or services in the market. An LLC, on the other hand, establishes a company as a separate legal entity, providing personal liability protection and potential tax benefits to its owners.

Whereas trademarks are concerned with intellectual property and brand identity, LLCs pertain to the structure and operation of a business. The processes for registration and maintenance of trademarks and LLCs also differ, with each following its own specific requirements and providing different forms of legal protection. Entrepreneurs must carefully consider both to ensure the comprehensive security of their business assets and brand reputation.

Quick Summary of Trademark vs LLC

- Trademarks offer protection for brand elements, while LLCs shield personal assets.

- The registration processes for trademarks and LLCs are distinct and cater to different aspects of business protection.

- Choosing whether to form an LLC or apply for trademark registration first should be based on individual business needs and strategies. Generally, an owner will want to form an LLC first to own the trademark and trademark registration and other intellectual property (such as copyright registrations and patent registrations)

Understanding Trademarks

Exploring the realm of trademarks opens up an understanding of how brands secure their identity and intellectual property in the marketplace.

Definition and Importance of Trademarks

A trademark is a distinctive sign or indicator used by an individual, business organization, or other legal entity to identify that the products or services to consumers with which the trademark appears originate from a unique source, and to distinguish its products or services from those of other entities. Trademarks are typically composed of a name, word, phrase, logo, symbol, design, image, or a combination of these elements, but can also be a color, design in packaging, or in rare cases a scent. For example: the red color on the bottom of Louboutin shoes, or the smell of Play-Doh were both granted trademark registration by the USPTO.

Purpose and Importance of a Trademark

They play a crucial role in establishing brand identity and help in safeguarding the intellectual property of a company. Recognized by the United States Patent and Trademark Office (USPTO), a trademark grants the owner exclusive rights to use it on a federal level, preventing unauthorized use by others, which could lead to confusion among consumers – a protection that is critical for brand protection. They can help with a variety of things for you business such as:

- Brand Recognition: Trademarks are instrumental in establishing a distinctive identity for your business. A recognizable trademark helps consumers associate products or services with a particular brand (which make include a brand name and brand identity), fostering trust and loyalty. This could include the business’s name.

- Legal Protection: Registering a trademark provides greater legal protection against unauthorized use than an unregistered mark. It grants the trademark owner exclusive rights to use the mark in connection with specific goods or services, offering a powerful tool to prevent competitors from using similar marks across the entire United States.

Trademark Rights and Registration Process

Common law Trademark rights are obtained through the legitimate use of the mark in commerce. However, for more extensive protection, businesses typically pursue federal trademark registration with the USPTO. The registration process involves several steps:

- Advanced searching of dozens of databases (including court records, domains, sub-domains, municipal records, state records, the USPTO database, and many more, using a sophisticated and specialized algorithm to determine whether the trademark is unique and not already in use, the likelihood of registration and distinctiveness of mark from others.

- Filing a trademark application through the Trademark Electronic Application System (TEAS).

- Examination by an attorney from the USPTO to review the application for any discrepancies and ensure compliance with all trademark laws.

- Publication in the Official Gazette to allow any oppositions to be filed by third parties.

- Successful registration if no opposition is filed or if the opposition is overcome with legal arguments.

By registering a trademark, a brand is afforded comprehensive brand protection that can later be used in enforcement actions against potential infringers, granting them the exclusive right to use the mark in relation to the goods or services listed in the registration (except for in cases of prior use, contact an attorney to discuss what this means). This also includes the ability to bring forth trademark infringement lawsuits in federal court should unauthorized use occur, protecting not just the brand’s identity but also the consumers from potential confusion. Federal registration symbolizes the government’s acknowledgment of ownership and endows the owner with federal rights to enforce the registered trademark nationwide.

Understanding Limited Liability Companies (LLCs)

Before diving into the world of Limited Liability Companies, one needs to understand what an LLC is and the processes involved in setting one up. The framework and regulations set up at the state level require attention to ensure both personal asset protection and proper legal entity formation.

LLC Basics

An LLC, or Limited Liability Company, represents a popular business structure in the United States, favored for marrying the liability protections of a corporation with the flexibility of a sole proprietorship. An LLC allows its owners, also known as members, to protect their personal assets from the company’s liabilities when certain rules are followed. This means that in the event of financial trouble or legal action in court against the LLC, the members’ personal assets are typically shielded from creditors and judgments.

In terms of taxation, LLCs enjoy “pass-through” tax benefits—profits and losses flow directly to members’ personal tax returns, preventing double taxation that corporations may face. The company structure is highly flexible, and the internal governance is guided by an operating agreement, which outlines the ownership and member arrangements set by the members themselves.

Purpose and Importance of an LLC

Some people often choose for their business either sole proprietorship or an LLC. Let’s explore the key features of LLCs:

- Limited Liability: One of the primary advantages of forming an LLC is the limited liability protection it offers to its members. This means that the personal assets of members are generally shielded from business debts and liabilities.

- Flexibility in Management: LLCs offer a versatile management structure, allowing members to choose between a member-managed or manager-managed setup. This flexibility is advantageous for businesses with varying levels of involvement among members.

Registration and Legal Entity

The process of starting a business as an LLC begins with the registration at the state level, typically through the Secretary of State’s office. Here’s a concise breakdown:

- Name Reservation: Before forming an LLC, it’s essential to choose a unique and available business name. Some states allow reservation of a business name for a specific period during the formation process. It’s a very good idea to contact an attorney to do a knockout search before choosing your name. Its is not uncommon to go through the trouble of creating a business name, filing the paperwork, spending money on marketing and branding only to be served with a cease and desist letter, or worse, a law suit because your name is infringing on an already existing companies name. Just because its available in your state’s company formation process, does not mean its not infringing upon someone else’s trademark rights (state’s formation databases do not overlap with the US Trademark Offices Databases.

- Choose a Registered Agent: This individual or company will accept legal documents on behalf of the LLC.

- File Articles of Organization: This is a formal document which includes key information about the LLC.

- Create an Operating Agreement: Legally required in New York State, drafting an operating agreement is also highly recommended for LLCs. This document outlines the internal workings of the business, including member roles, profit distribution, and decision-making processes. This document is imperative to set expectations within the company, even between just two partners/members, early on to help avoid unintended consequences down the road.

- Obtain Necessary Licenses and Permits: Depending on the type of business and location, various local permits may be needed.

- Obtaining an EIN and Register for State Taxes: An Employer Identification Number (EIN) is necessary for tax purposes and is obtained from the Internal Revenue Service (IRS).

When successfully registered, the LLC becomes a distinct legal entity separate from its members and shields them from most cases of personal liability. It is capable of owning property, entering into contracts, and is responsible for its own debts and liabilities. This clear separation provides a layer of asset protection. Unlike sole proprietorships, where the owner and the business are legally considered the same, an LLC ensures that members are not typically personally responsible for business debts and liabilities.

Legalities and Liabilities

When considering the structure of a business, it’s imperative to understand the different legal implications and liabilities between trademarks and LLCs. Each offers distinct levels of protection for an owner’s assets and can impact how a business is perceived legally.

Protection from Liabilities

Limited Liability Companies (LLCs) provide personal liability protection to their owners, which separates an owner’s personal assets from the company’s debts and liabilities. In the event of litigation or bankruptcy, an LLC (except for in cases of fraud or where the corporate veil is pierced protects the owner’s homes, cars, savings, and other assets. This legal protection is crucial for owners to safeguard their personal property against lawsuits and creditors.

Sole Proprietorship vs LLC

A sole proprietorship, while straightforward and inexpensive to establish, offers no distinction between the owner and the business and is usually established by a simple form with a state or county’s office. However, this means that there’s no personal liability protection at all; the owner is fully responsible for all liabilities incurred by the business. If sued, the owner’s personal assets could be at risk to satisfy business debts and legal judgments.

- No separation between personal assets and business liabilities

- Owners bare all responsibility for debts and actions of the business

In contrast, forming an LLC establishes a business as a separate legal entity, providing a shield against personal liability. This entity structure ensures that the owner’s assets are not directly exposed to any financial and legal vulnerabilities that arise from the company’s operations, including partnership obligations, legal actions, and potential bankruptcies.

Costs and Procedures

When establishing a business identity, understanding the financial and procedural aspects of trademarks and LLCs is crucial. Each has different associated costs and steps that must be adhered to for proper registration and maintenance.

Trademark Costs

The cost of registering a trademark varies depending on the filing route one chooses. Applying for a trademark registration should be viewed as an investment in your company, service, product, or brand. It is one of the best ways to build value in the thing you sell or do. There are generally two costs with US trademark applications, the cost to pay the attorney to analyze and draft the application and the cost of the classes of goods and services themselves

The United States Patent and Trademark Office (USPTO) charges a filing fee that ranges from $250 to $750 per trademark class. Depending on how many classes (sometimes thought of as “categories”) one needs. E.g., if you sell a tennis ball, that may be in Class 21 for Games, Toys, and Sports Goods, but if you also sell it to cover a pick-up truck hitch that might go under Class 12 for Aftermarket automobile accessories. This fee is non-refundable, regardless of the application’s success.

Applicant’s attorney should conduct due diligence through a comprehensive search, also known as a knockout search or clearance search of existing trademarks to ensure the uniqueness of their business name. Although not mandatory, employing an attorney to navigate the complex paperwork and vast amount of databases and results, can incur additional costs but adds value in legal expertise and lower’s risk of infringing on another’s trademarks.

LLC Costs and Maintenance

The costs to form an LLC (Limited Liability Company) differs by state, with filing fees ranging from $40 to $500. Post-establishment, LLCs may have annual fees or reports that maintain their good standing, adding to the overall cost. LLCs offer legal protections, shielding personal assets from business debts and liabilities. They are favored for their pass-through taxation, where income is taxed at the owner’s personal tax rate, potentially providing tax benefits.

Additionally, maintaining an LLC requires keeping records and adhering to the business structure’s formalities. Depending on the complexity, its It’s a good idea to include a lawyer during this process. LLCs can be invalidated if the processes are not followed precisely, leaving the owner’s exposed personally to judgments.

Overall Key Differences Between Trademarks and LLCs

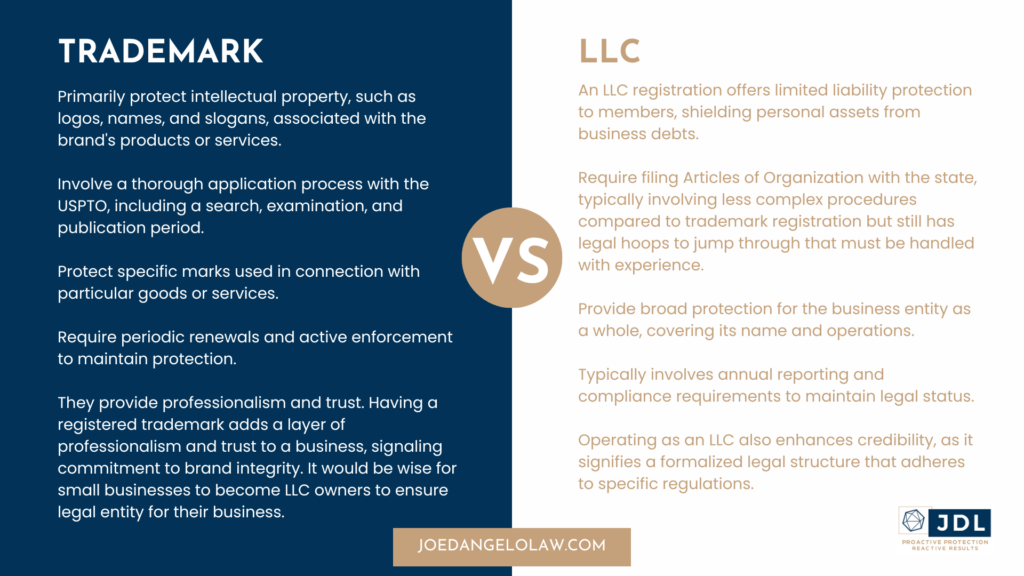

| Trademark | LLC | |

|---|---|---|

| Nature of Protection | Primarily protect intellectual property, such as logos, names, and slogans, associated with the brand's products or services. | An LLC registration offers a limited liability protection to members, shielding personal assets from business debts. |

| Registration Process | Involve a thorough application process with the USPTO, including a search, examination, and publication period. | Require filing Articles of Organization with the state, typically involving less complex procedures compared to trademark registration but still has legal hoops to jump though that must be handled with experience. |

| Scope of Protection | Protect specific marks used in connection with particular goods or services. | Provide broad protection for the business entity as a whole, covering its name and operations. |

| Renewal and Maintenance | Require periodic renewals and active enforcement to maintain protection. | Typically involve annual reporting and compliance requirements to maintain legal status. |

| Enhancing Business Credibility | They provide professionalism and trust. Having a registered trademark adds a layer of professionalism and trust to a business, signaling commitment to brand integrity. It would be wise for small businesses to become LLC owners to ensure legal entity for their business. | Operating as an LLC also enhances credibility, as it signifies a formalized legal structure that adheres to specific regulations. |

Frequently Asked Questions: Trademark vs LLC

This section addresses common inquiries regarding the distinctions and implications of trademarks and LLCs for business entities.

Is an LLC and Trademark the Same?

No, an LLC and trademark are not the same. An LLC (Limited Liability Company) and a trademark serve distinct purposes in business. An LLC shields owners’ personal assets from business liabilities, while a trademark protects brand identity and intellectual property like logos and slogans. While both are crucial for business protection, an LLC focuses on liability, while a trademark safeguards brand identity.

What are the legal differences between a trademark and an LLC?

A trademark is a symbol, design, phrase, or word that identifies and distinguishes the source of the goods or services of one party from those of others. An LLC, or Limited Liability Company, is a business structure in many of the states in the United States that provides personal liability protection to its owners and can be taxed in various ways depending on the elections made by the LLC and its number of members.

Is it necessary to trademark a business name if I already own an LLC?

While an LLC legally registers the business name at a state level and prevents others in the same state from forming an LLC with the same name, a trademark offers protection on a federal (and national) level against other businesses using a similar or identical name for related goods or services.

Should a trademark be registered before forming an LLC?

Business owners sometimes register a trademark before forming an LLC to ensure the desired business name is not already trademarked and to afford early protection for the name or logo associated with their goods or services, preventing others from using it nationwide.

What are the advantages of a business owning a trademark versus an individual?

A business owning a trademark can build brand recognition and deter others from using a similar brand name in the marketplace. Businesses can also leverage trademarks as assets, using them for sales, franchising or licensing, thus potentially increasing the business’s value.

Can one register a trademark that is different from their current LLC name?

Yes, one can register a trademark that is different from their current LLC name; trademarks do not have to match the name of the business entity. Trademarks protect branding elements, whereas LLC names simply reflect the legal name of the company. An example might be Coca-Cola Company not only having the trademark for “COKE” but also for “Share a Coke, Share a Moment”, Cherry Coke Zero.

How does one go about registering a business name as a trademark?

To register a business name as a trademark, one must file an application with the United States Patent and Trademark Office (USPTO), ensuring the name meets all trademark guidelines and isn’t already in use or too similar to existing trademarks, as described by the USPTO’s registration criteria.

There are the differences between a Trademark vs LLC. It’s very important to protect your assets with a legal entity such as an LLC and your brand with a trademark. If you have any comments or concerns about the process, please contact our firm.

The information provided in this blog, article, or video post is for general informational purposes only and is not intended to be legal advice. The matters discussed in this article may be complex and subject to varying interpretations and applications depending on the specific facts and circumstances, and changes in law. This post is not a substitute for professional legal advice tailored to your individual situation. No reader should act or refrain from acting on the basis of any information included in, or accessible through, this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction. This blog post nor anything on this website shall create an attorney-client relationship.

This blog post is considered lawyer advertising. Prior results do not guarantee a similar outcome.